Report #3a

California�s Tax System �

Personal

Income Tax Weakness & Possible Remedies:

Volatility is Too Great

"Know New Taxes" (a look at environmental taxes), SF Chronicle, 9/19/07

Annette

Nellen

Tax

Professor at

Introduction

The personal

income tax (PIT) is the largest revenue generator for

The California

PIT is computed starting with federal adjusted gross income (AGI) with

various adjustments. The graduated rate structure is comprised of 6 rates:

1%, 2%, 4%, 6%, 8%, and 9.3%. In addition, individuals with taxable income

over $1 million must pay an additional 1% on the amount over $1 million.

This additional tax is designated as a mental health services tax.[3]

The 10.3%

maximum tax rate (9.3% + 1% special tax) represents the highest maximum

rate among the states. The top tax rates and number of tax brackets for

selected states follows.[4]

|

State |

Top

rate |

Top

rate applies to income over |

#

of tax brackets |

|

|

9.3% 10.3% |

$86,934 $1,000,000 |

7 |

|

|

4.63% |

Flat

tax |

1 |

|

|

8.25% |

$96,000 |

9 |

|

|

3.0% |

Flat

tax |

1 |

|

|

8.98% |

$60,436 |

9 |

|

|

7.85% |

$123,751 |

3 |

|

|

6.85% |

$40,000 |

5 |

|

|

9.00% |

$13,702 |

3 |

|

|

9.5% |

$336,551 |

5 |

Because the PIT

is a very significant revenue generator for

|

State |

PIT |

Corp.

Income Tax |

Sales/Use

Tax |

Licenses |

Property

Tax |

Other |

|

|

46.0% |

9.3% |

35.9% |

6.8% |

2.0% |

<

1% |

|

|

50.0% |

5.4% |

38.2% |

3.9% |

0% |

2.5% |

|

|

30.7% |

8.5% |

50.4% |

8.8% |

< 1% |

1.4% |

|

|

54.1% |

9.6% |

30.6% |

3.4% |

< 1% |

2.3% |

|

|

26.3% |

8.0% |

48.9% |

5.8% |

9.4% |

1.6% |

|

|

56.5% |

7.4% |

29.9% |

2.4% |

0% |

3.8% |

|

|

40.4% |

4.5% |

46.5% |

8.6% |

< 1% |

< 1% |

|

|

0% |

0% |

77.4% |

13.8% |

0% |

8.8% |

|

|

52.8% |

5.0% |

33.3% |

3.7% |

< 1% |

5.1% |

|

State

total |

34.6% |

6.7% |

46.7% |

6.4% |

1.7% |

3.9% |

Weakness:

Remedy:

Reduce the volatility by replacing some portion of the PIT with other

taxes and lower the threshold at which individuals become subject to PIT

in conjunction with providing other tax relief for low-income taxpayers.

Extent and Causes of the

Volatility

Exemptions and

tax credits significantly lower PIT liability for many Californians. That

leaves more of the tax to be collected from higher income individuals. In

2006, a married couple with two dependents did not owe

The Center for

Budget and Policy Priorities reports that

|

State |

Single-parent/2

children |

Married

parents/2 children |

|

|

$4,600 |

$4,600 |

|

|

$11,100 |

$14,400 |

|

|

$13,600 |

$15,600 |

|

|

$14,600 |

$17,500 |

|

|

$24,300 |

$26,200 |

|

|

$32,500 |

$36,300 |

|

|

$42,400 |

$44,700 |

|

Average

of states |

$19,400 |

$22,500 |

|

Poverty

line |

$16,079 |

$20,615 |

In 2004,

Californians with adjusted gross income (income before most deductions)

over $100,000 paid 80% of the PIT collected by the state while roughly 64%

of individuals with income under $50,000 paid about 3% of the PIT. The

breakdown showing number of taxpayers and the percent of total PIT paid by

that income group is shown in the following chart from the Governor�s

2007-2008 budget report.[9]

These figures

indicate that the PIT primarily applies to top income producers. This

dependence on collecting a significant portion of tax revenues from a

small number of individuals though is risky so far as ensuring a stable

revenue base. When there is a drop in the income of the top 10% of

income-generators, as can easily happen in a weak economy, the entire

state is impacted due to a drop in its largest revenue source. As noted in

the Governor�s 2007-2008 budget report: �Changes

in the income of a relatively small group of taxpayers can have a

significant impact on state revenues.�[10]

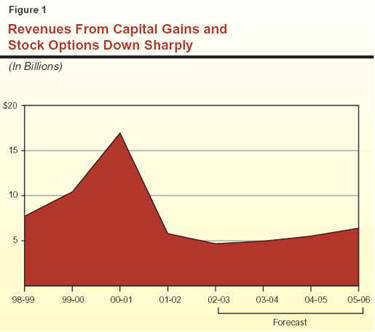

This is what happened in the �dot.com� boom and bust several years

ago.

The �dot.com� boom generated larger than usual

stock option spreads for many individuals as well as larger than usual

capital gains from the sale of stock. The LAO reported that in 1999,

income from capital gains and stock options increased about 50%, and

increased 30% in 2000.[11]

Then with the �dot.com bust,� this revenue dropped. The unevenness of

capital gain and stock option income is illustrated in the LAO chart

below.[12]

The situation as described by the LAO:

�The dramatic impact of the stock market decline

is depicted in Figure 1, which shows the amount of personal income

taxes attributable to stock options and capital gains. It indicates that

these tax revenues peaked at $17 billion in 2000-01, but fell

abruptly following the stock market decline�to under $6 billion in

2001-02. This unprecedented 66 percent decline is the key factor

behind the $10-plus billion annual mismatch between revenues and

expenditures that began in 2001-02.�[13]

The following chart, also from the LAO, shows the

breakdown in capital gain and stock option income.[14]

The LAO report noted that in 2000, the over $17

billion of taxes paid on capital gains and stock option income represented

over 22% of total General Fund revenues. The LAO projected that due to a

declining stock market, these sources of PIT would decrease about $10

billion in the subsequent year.[15]

In

summary, factors that make the PIT volatile are:

- Reliance on a small

number of high-income taxpayers to generate a significant portion of

the PIT revenue.

- The effect of

unpredictable and uneven stock gains on the PIT base.

- Bracket compression

that causes the 9.3% bracket to start at roughly $87,000 (in 2006).

- A large portion of the

aggregate AGI base not being subject to PIT.

Why Volatility

Should Be Addressed

A

revenue base that is stable and predictable helps legislators and the

governor make spending decisions and determine whether tax law changes are

needed. A volatile tax that at times generates more revenue than expected

can lead to spending problems if there are no provisions or efforts to

either set the extra revenue aside for a future time when PIT collected is

less than expected, or to use the extra revenue for one-time spending

(rather than base spending).

Challenges

The

remedies for volatility problem are not ones that would be easy to

implement. Also, solutions would need to be implemented in conjunction

with other changes to keep tax collections steady.

Recommendations for

Reducing Volatility

A

combination of changes is needed to reduce the volatility in the PIT. The

PIT needs to be collected from more taxpayers. That is, more aggregate

income needs to be subject to PIT. The volatility could also be reduced by

reducing the slice of the total tax revenue pie attributable to the PIT.

Following are techniques for spreading out collection of PIT and reducing

the state�s reliance on this tax.

- Stretch out the PIT

rate structure so that a low rate applies to lower income individuals.

For example, apply the 1% rate (or perhaps drop the lowest rate to

0.5%) to lower levels of taxable income. Then apply the 2% rate to a

higher income level as well as the 4% rate and so on until the 9.3%

rate applies to higher levels of taxable income than is the case now.

- Add new taxes, such as

on energy use, that apply to high levels of usage, such as might be

the case for individuals with large homes (see Report #11). In

addition, the sales tax base should be broadened and the rate lowered

(see Report #2a). These changes would replace the revenue lost by

reducing PIT collections.

Other techniques for

reducing volatility include:

- Reduce the tax rate on

capital gain income since that is the most volatile type of income

currently subject to tax. Other changes would be needed to replace any

lost revenue.

- Modify the PIT formula

such that the amount owed is a percentage of the federal income tax

liability, lower the amount collected and make up the difference with

increased sales taxes (through base broadening) or alternative taxes.

Tax

Policy Analysis[16]

The following chart explains how reducing volatility of the PIT would

satisfy the principles of good tax policy. The rating in the last column

indicates how change to reduce volatility would improve the current

system.

|

Principle |

Application

and Analysis |

Rating |

|

Fairness |

||

|

Equity

and Fairness |

The current PIT has a high degree of

vertical equity (those with higher incomes pay significantly and

proportionally more than those with lower income). Many individuals

with income do not pay any PIT though which hurts vertical equity. |

+ |

|

Transparency

and Visibility Taxpayers should know that a tax exists and how and when it is imposed upon them and others. |

no change | |

|

Operability |

||

|

Certainty |

No change |

|

|

Convenience

of Payment |

No change |

|

|

Economy

in Collection |

No change |

|

|

Simplicity |

No change |

|

|

Minimum

Tax Gap |

If more taxpayers become subject to

paying PIT, the tax gap might increase. |

- |

|

Appropriate

Government Revenues |

Reducing the volatility of the PIT would

make this tax a more predictable revenue source for the State. |

+ |

|

Appropriate

Purpose and Goals |

||

|

Neutrality |

No

change |

|

|

Economic

Growth and Efficiency |

A

more stable revenue source should stabilize spending and reduce the

likelihood of budget deficits. |

+ |

[1]

Legislative Analyst�s Office (LAO), Analysis

of the 2007-08 Budget Bill: Perspectives

and Issues (perspectives on state

revenues); available at http://www.lao.ca.gov/laoapp/analysis.aspx?year=2007&chap=8&toc=1.

[2]

LAO, Reforming California�s Tax System, 1/22/04, pg. 4; available at

http://www.lao.ca.gov/handouts/fo/2004/Reforming_California_Tax_System.pdf.

[3]

This tax was created by Proposition 63, passed by voters in 2004. This

report includes this 1% rate as part of the PIT because it is computed

using

[4]

Information from Federation of Tax Administrators, as of 1/1/07;

available at http://www.taxadmin.org/fta/rate/ind_inc.html.

[5] See next section for references.

[6]

From the U.S. Census Bureau, State Tax Collections 2006; available at http://www.census.gov/govs/www/statetax06.html.

This data includes various license revenue in the tax collection data

which is why

[7]

See 2006 exemption amounts and tax rates at http://www.ftb.ca.gov/forms/06_forms/06_540bktoc.asp.

[8]

Jason A. Levitis, Center for Budget and Policy Priorities, The Impact

of State Income Taxes on Low-Income Families in 2006, 3/27/07, pg 12;

available at http://www.cbpp.org/3-27-07sfp.pdf.

[9]

Governor�s Budget 2007-2008, General Fund Revenue; available at http://www.ebudget.ca.gov/BudgetSummary/REV/26639985.html.

[10] Governor�s Budget 2007-2008, General Fund Revenue; available at http://www.ebudget.ca.gov/BudgetSummary/REV/26639985.html.

[11]

LAO, California�s Fiscal Outlook, LAO

Projections, 2000-01 Through 2005-06, Chapter 3 Revenue

Projections, 11/15/00; available at http://www.lao.ca.gov/2000/fisc_outlook/111500_fiscal_outlook_chapter_3.html.

[12]

LAO,

California

�s

Fiscal Outlook, LAO Projections, 2002-03 Through 2007-08, 11/14/02;

available at http://www.lao.ca.gov/2002/fiscal_outlook/fiscal_outlook_2002.html.

[13]

[14]

LAO,

[15]

[16]

This analysis uses a document prepared by the American Institute of

Certified Public Accountants (AICPA) Tax Division and altered to the

above format by Joint Venture: Silicon Valley Network. The AICPA

document, Guiding Principles of

Good Tax Policy: A Framework for Evaluating Tax Proposals (2001)

is available at http://ftp.aicpa.org/public/download/members/div/tax/3-01.pdf.

The Joint Venture workbook is available at http://www.jointventure.org/PDF/taxworkbook.pdf.

The principles laid out in these documents are frequently used

tax policy analyses ones. For more information see Nellen, Policy

Approach to Analyzing Tax Systems; available at http://www.cob.sjsu.edu/facstaff/nellen_a/Policy%20Approach%20to%20Analyzing%20Tax%20Systems.pdf.

Note: The author of this report (Annette Nellen) was the lead author

for both the AICPA and Joint Venture documents noted here.