Tax Information

Tax Year

For income tax reporting purposes, the tax year is December 1 through November 30. As December’s paycheck is issued January 1 of the following year, it is considered income for the new tax year.

Manage Your Withholding Information

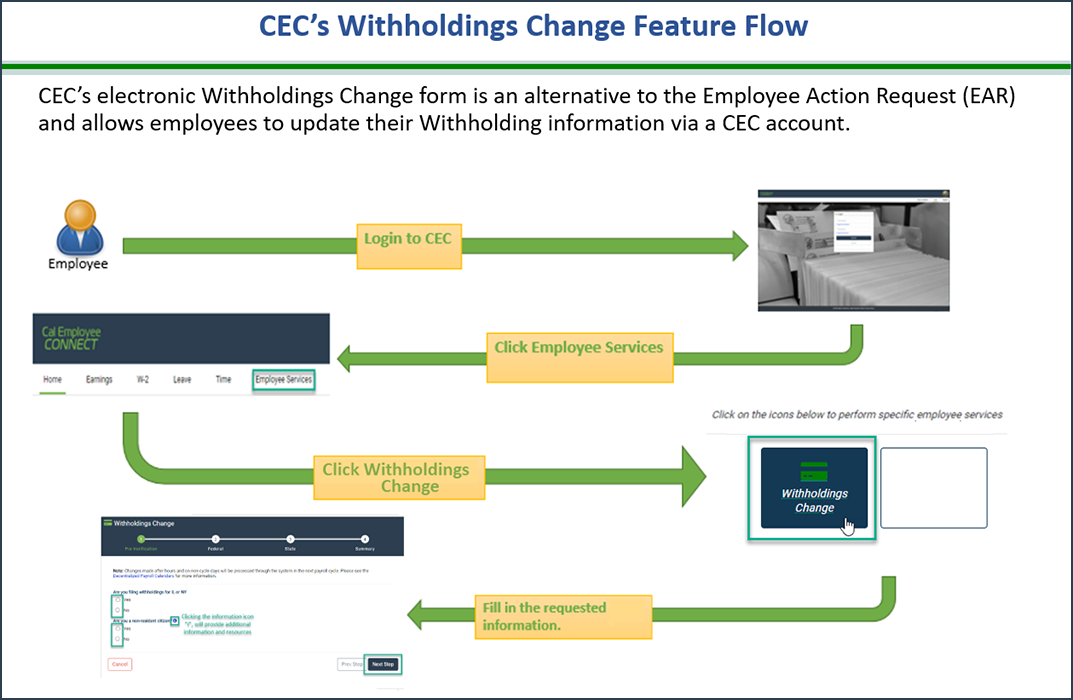

Cal Employee Connect (CEC) is used to make any tax withholding changes state employees wish to make. If you have not registered for CEC, now is the time. You can change your tax withholdings using CEC Employee Services feature and Multifactor Authentication (MFA).

See the Paycheck Calculator to estimate net pay based on changes in withholding.

Withholdings Multifactor Authentication (MFA)

Multifactor Authentication is an additional level of security and is required to submit

a Tax Withholdings Change via Cal Employee Connect. Enable Multifactor Authentication (MFA) User Guide [pdf]

View your current tax withholding status

- Login to Cal Employee Connect

- Click on 'Earnings' tab

- Click on most recent Earnings Statement

- View 'Tax Status' in Earning Statement Detail

Update your current tax withholding status

Navigate to the “Employee Services” section of CEC and select the "Withholdings Change" option.

For detailed step-by-step instructions, please refer to the CEC Withholdings Change User Guide [pdf].

Note:

- CEC processes Withholdings change requests by close of business Monday through Friday; please allow 24 hours for submitted changes to reflect in your CEC account. If the change is submitted Friday evening through Sunday, the changes will be processed the following Monday and changes may reflect in your CEC account as early as Tuesday morning.

- The CEC Team is a technical team and unable to advise on withholdings change. If you have any questions regarding your Withholdings change, please refer to the IRS website.

For technical questions or technical assistance with the Withholdings Change feature, please contact the CEC team at Help & Feedback.

Form W-2 Information

View current and prior W-2s through Cal Employee Connect. Please visit Cal Employee Connect for information on how to register.

For additional information contact your payroll representative.