Compensation Planning and Management

Compensation for employees - faculty, staff, and students -represents the largest component of the campus expenditure budget.

The processes and management of employee positions and compensation funding vary across the Divisions. Please contact your Division resource management team for more information about their position management process.

CSU Operating Fund

Employees' salaries, wages, and benefits represent over three-fourths of the CSU Operating Fund budget. Divisions are allocated an expenditure budget to support employee compensation costs.

Salary Budgets

At the beginning of each fiscal year, salary budgets are updated to account for all active filled and vacant positions based on position listing reports submitted by Divisions to the Office of Budget Planning & Financial Management. The position listings should be maintained throughout the year to track approved positions and monitor the budget allocated to each position.

In general, all permanent positions are to be budgeted for an entire fiscal year. Anticipated budget savings for vacancies may be allowed subject to approval or direction from the campus leadership through the Office of Budget Planning & Financial Management.

Compensation Adjustments

The CSU is subject to the terms of agreements made with employee unions. Collective Bargaining Agreements (CBA) may be viewed online from the CSU Labor and Employee Relations website. The agreements may include negotiated compensation increases for employees.

Some common types of compensation increases include General Salary Increases (GSI), one-time bonuses/stipends such as Long-Term Satisfactory Service Bonus (LTSS), Educational Achievement Stipend, Budget Shortfall Mitigation Bonus (BSM), and Rural Health Stipends.

The CSU may or may not receive full funding from the State of California to cover the cost of salary adjustments resulting from Collective Bargaining Agreements. When possible, the CSU allocates funding for compensation to the campuses to cover unit-wide cost increases. That funding may be initially provided to the campus as one-time funding, with base funding in the following year. To the extent funding allows, the university will allocate additional budget to Divisions to cover the cost of unit-wide cost increases (salaries and benefits).

Compensation increases provided outside of the Collective Bargaining Agreements typically reflect decisions made by campus administrators. Such adjustments are not funded by the State, CSU, or central university budget. Examples include faculty and staff promotions, in-classification-range progressions, reclassifications, and reassignments. Departments need to coordinate with the Division resource management to ensure funding is available for proposed department-initiated salary actions before submitting an action request to University Personnel.

Benefits Budgets

For the CSU Operating Fund, the university maintains a centralized Benefits Pool which covers the benefit costs related to positions charged to the CSU Operating Fund. The funding for benefits is held centrally in the Pool and allocated monthly to cover the actual benefit costs charged during the monthly labor cost distribution.

As adjustments to the position listing and salaries budget are made, corresponding adjustments are also made to the Benefit Pool to keep pace with future costs. In recent years, benefit costs have been approximately 50% of salary costs.

Student Success, Excellence and Technology Fee (SSETF)

For positions supported by the Student Success, Excellence, and Technology Fee (SSETF), the budget process is similar to the CSU Operating Fund. Position listings are requested, funding is allocated when possible to cover unit-wide employee cost increases, and a central Benefits Pool exists to allocate budget monthly to cover employee benefit costs. Additional restrictions apply to SSETF for employee bonuses. Departments are asked to coordinate with the Division resource management to ensure funding is available for proposed department-initiated salary actions before submitting a request to University Personnel.

Self-Support Units and Trust Funds

For other self-support enterprise units and trust funds, all compensation costs and adjustments are funded from the program’s resources. The largest self-support enterprise units are required to submit an annual business plan which includes an employee position listing and a multi-year salaries and benefits budget. Additional details may be found online or in the annual call for plan submissions which is distributed by the Office of Budget Planning & Financial Management each spring.

Salary Budgets

Like the CSU Operating Fund, at the beginning of each fiscal year, salary budgets are updated to account for all active filled and vacant positions based on position listing reports submitted by Divisions to the Office of Budget Planning & Financial Management. The position listings should be maintained throughout the year to track approved positions and monitor the budget allocated to each position.

In general, all permanent positions are to be budgeted for an entire fiscal year. Anticipated budget savings for vacancies may be allowed subject to approval or direction from the campus leadership through the Office of Budget Planning & Financial Management.

In the case of self-support units, departments should include any anticipated compensation increases in the budget submission. Planning parameters for such adjustments are included in the annual call for Business Plan submissions. Programs are subject to the most current Collective Bargaining Agreement terms and associated cost increases.

Benefit Budgets

The average benefits rate as a percentage of salaries and wage costs varies across the self-support units and trust funds based on salary levels, unit benefits, and employee elections. Self-support units and trust funds should budget for benefit costs based on the historical benefit rates for the program, accounting for expected increases associated with salary adjustments and other benefit rates, notably employer-paid retirement costs and health premiums.

Federal Work Study

What is it?

Federal Work Study is a type of student financial aid award that allows students to apply for part-time work study positions, based on their financial needs. The federal government provides a grant (70%) and there is a department matching component (30%), which make up the total department work study budget. Federal Work Study must be budgeted and paid from Fund 70000.

Types of Federal Work Study

There are three types of Federal Work Study programs:

- On Campus employers (various departments.)

- On-Off Campus employers (Student Union, University Housing Services, Research Foundation, Tower Foundation, etc.)

- Off Campus employers (school districts, city and county governments, etc.)

What is the correlation between the student awards and budgets?

There is NO automatic correlation between the student federal work study awards in your department and your department federal work study budget (account code 602XXX) in the SJSU Operating Fund 70000.

What does the budget process look like?

At the beginning of each fiscal year, the Financial Aid and Scholarship Office provides the Office of Budget & Financial Management with a Federal Work Study allocation amount for each division. Base budgets are typically assigned based on historical arrangements; and any divisional requests for an increase in budget allocation should be sent to the Financial Aid & Scholarship Office by the spring semester. Budget & Financial Management adjusts the divisional budget based on the amounts provided by the Financial Aid and Scholarship Office.

Budget & Financial Management also transfers the 30% matching requirement from each division’s operating expense budget into the work study account if it isn’t included as a base budget already. The on and on-off campus agencies’ work study allocations are sent to Accounting Services. The on and on-off campus’ payrolls are processed through the university payroll system and off campus payrolls are processed by agencies’ payroll systems. The agencies then receive reimbursements from the university for the Federal portion. Please contact Accounting Services for information on moving work study expenses and processing of the on-off campus and off campus work study for agencies and auxiliaries.

At mid-year, Budget & Financial Management reviews Federal Work Study expenses and may reallocate the budget. Because Federal Work Study funds are limited, any surplus balances of the 70% grant budget are reallocated to divisions who request more funds. The 30% matching portion returns back to divisions who are projecting a surplus, and divisions who received a portion of the reallocated grant funds allocate the additional 30% portion of their operating expenses to Federal Work Study. Budget & Financial Management coordinates all these activities with divisions.

It is the responsibility of the departments and agencies to manage their student work study award(s) and their Federal Work Study budget each fiscal year. Departments must fund all overruns, often by processing HR Expense Adjustments to charge overruns as Student Assistant payroll expenses.

At year-end, a similar reallocation process occurs. If you have any questions about the Federal Work Study budget process, please contact us.

For additional information about Federal Work Study from a student-award perspective, visit the Financial Aid and Scholarship Office website.

Faculty Release Time

What is Release Time?

Reimbursed Time: Personnel time (typically faculty time) that is reimbursed by a third party, usually the Research or Tower Foundation.

Reimbursed Time Authorization (RTA): the RTA form is initiated by the Foundation and defines the term, reimbursed increment (e.g., 0.20 = one course for one semester), funding source, and other information about the reason for the reimbursement. The form also gathers all necessary authorizations.

What is the Financial Process?

Once an RTA is fully signed, the initiating Foundation will send a copy to SJSU Accounting. The RTA serves as an “invoice request” and will be used to generate an invoice to the Foundation for the personnel reimbursement.

When the bill is generated, credits will post to the SJSU department, which serves as the reimbursement. Two credits will post: account 601817 reflects the reimbursement for academic salary costs, and account 603810 reflects the reimbursement for benefits costs. The salary credit represents the authorized amount now available to the department to hire temp faculty to cover the courses not being taught be the faculty on release time who is working on their research project.

Sample Situation with Finance Data Warehouse Report

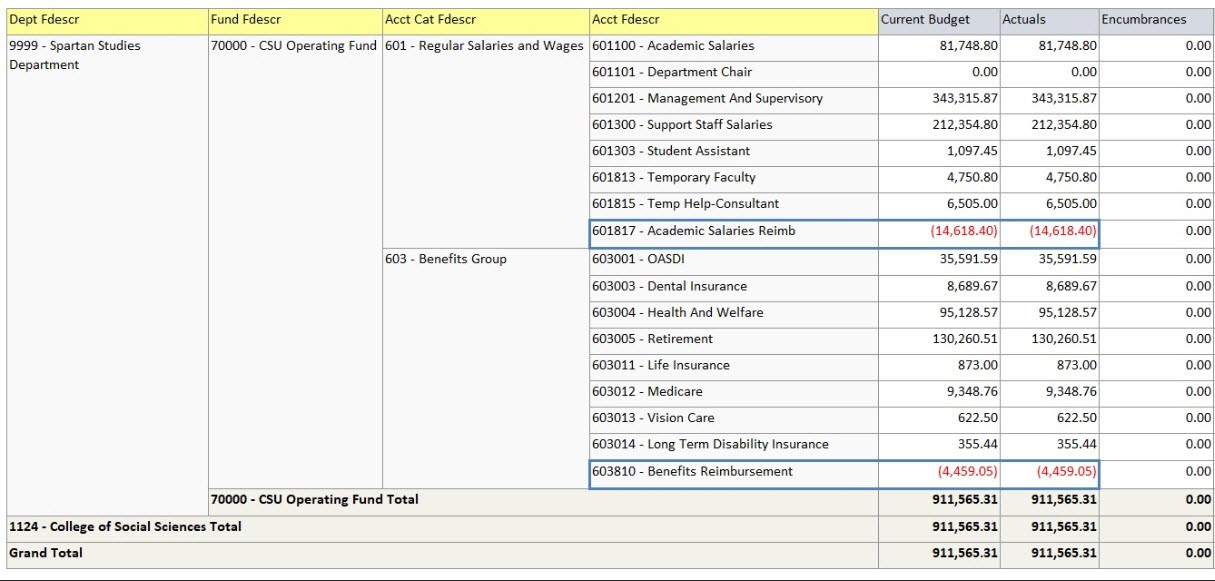

In the image below, the Spartan Studies Department received $14,618.40 in salary reimbursement and $4,459.05 in benefits reimbursement for Professor Jesson. Professor Jesson is working on sponsored research (she has a grant), and the grant pays 20% of her salary for the year. An RTA was processed to reimburse Spartan Studies for an amount equivalent to one course in fall and one course in spring (0.20 Academic Year).

Once the RTA is processed, the reimbursement amounts post to the Actuals column. For transactions in Fund 70000, Budget entries are made to match the amounts in the Actuals column via the monthly salary allocation process. For transactions in Fund 78005 and 78006, there will not be any budget adjustments for the central compensation pool.

The Spartan Studies Department now has authority to hire instructors to cover the courses normally taught by Professor Jesson in fall and spring while she is working on her research project.